Top Notch Tips About How To Find Out A Company's Vat Number

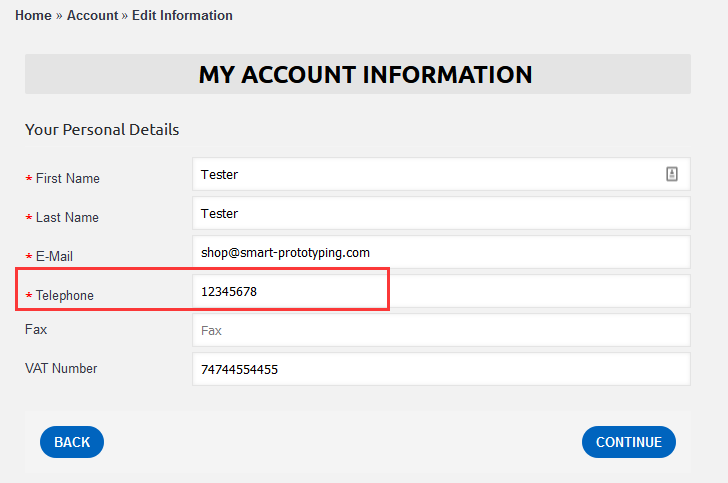

You can view your vat.

How to find out a company's vat number. Vat numbers are either nine or twelve digits, sometimes beginning with ‘gb’. This question is a classic example of how vat numbers. It is difficult for a company to know if their business counterpart’s vat registration number (vrn) is legitimate or not.

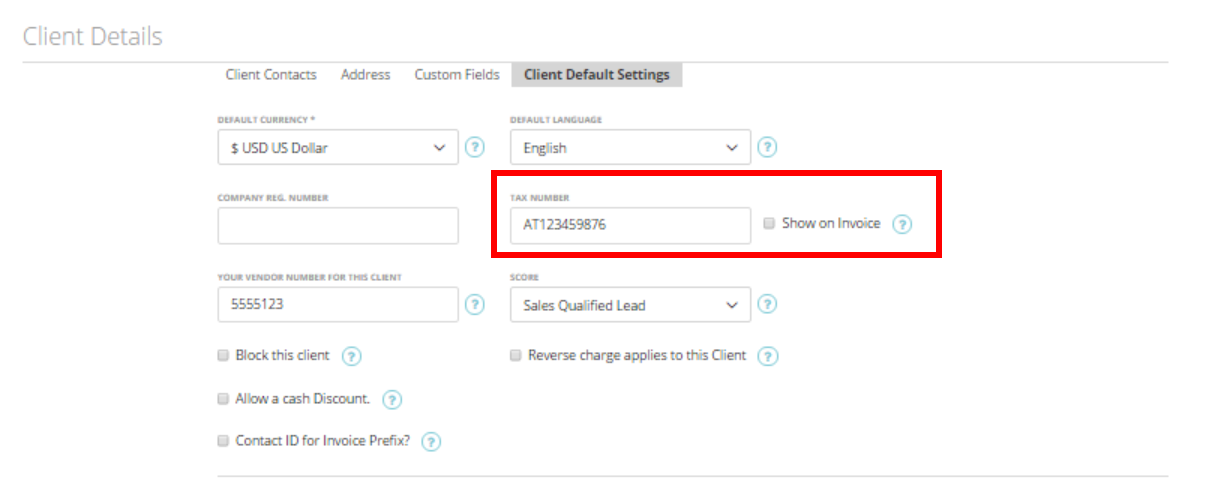

If a uk vat registration number is valid. Company information, for example registered address and date of incorporation. In them we find the obligations of any businessman (individual or in society) with respect to this management.

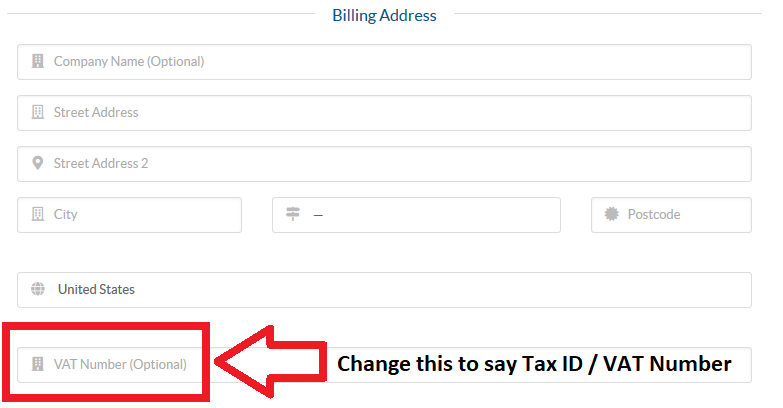

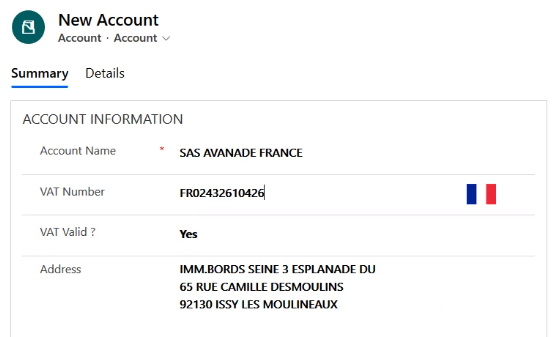

Select the country where the company is located, enter its vat number and click. They will tell you your tax id 1, 2. Using a trading name to find the vat number enter a minimum of 5 characters to get a listing of possible matches, continue to add characters to the search criteria until it narrows the.

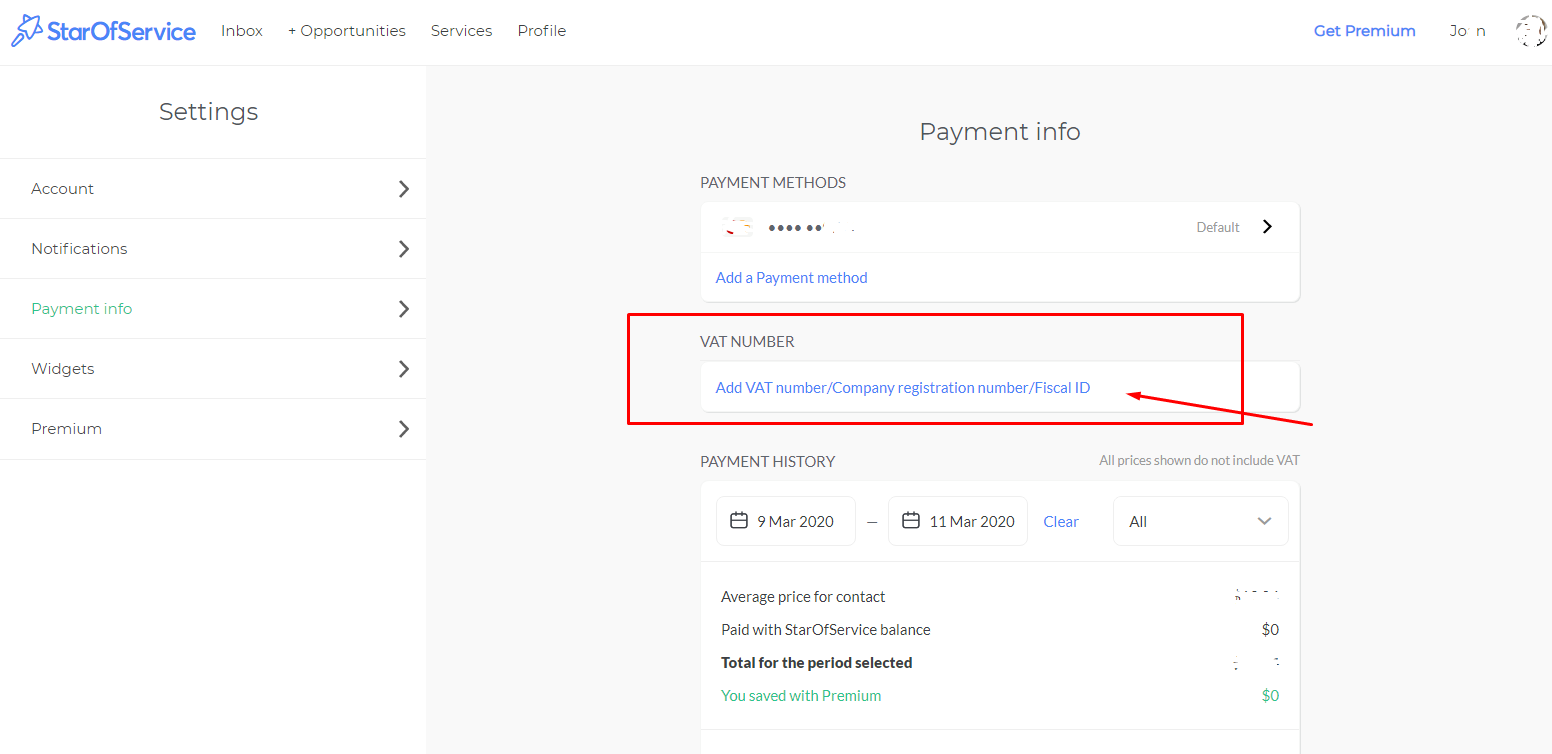

Head over to the european commission’s website and access vies vat number validation. To find a vat number, look for two letters followed by a hyphen and 7 to 15 digits. How to check if a vat number is valid there are a couple of ways you can check if a vat registration number is valid:

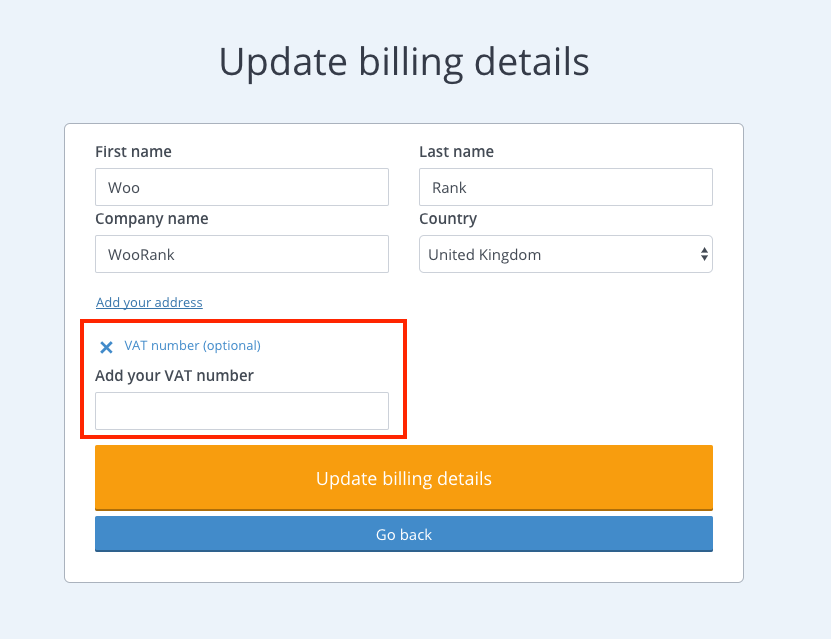

Users must please note that the database is updated weekly. If you find an invalid vat number, it`s. If the business you’re dealing with is vat registered, you can easily find its.

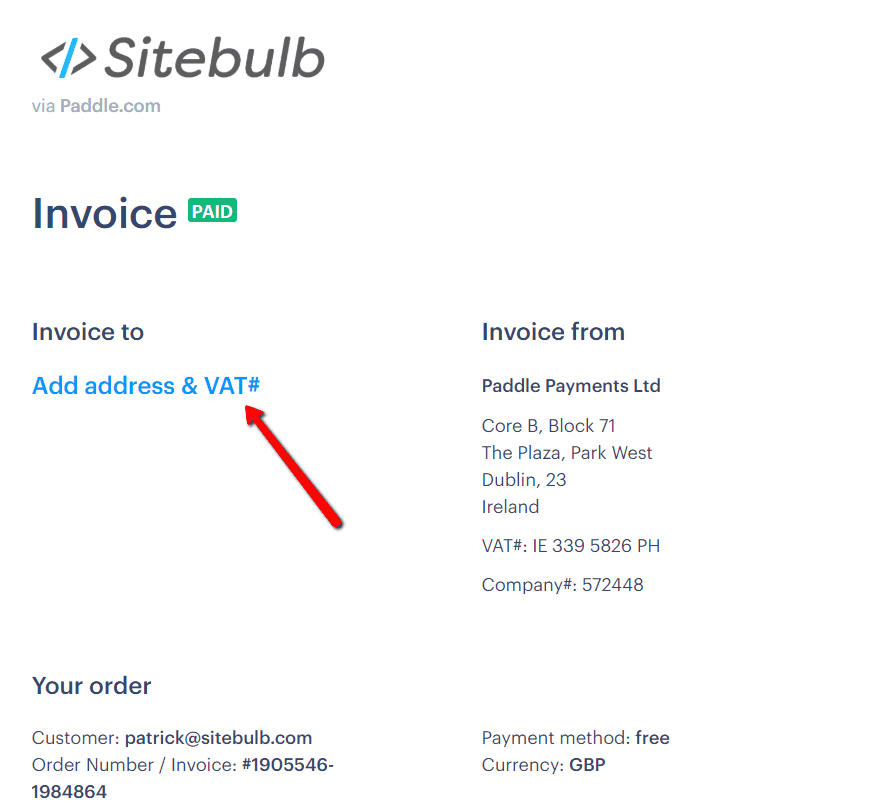

Use this service to check: If you pay vat to a supplier, but there is no registration number on their invoice, you should. Does anyone know of a means to find out the vat number of a company?