Brilliant Strategies Of Tips About How To Buy Goi Bonds

Retail investors can place their.

How to buy goi bonds. In simpler terms, a bond is a formal contract to repay borrowed money with an interest at fixed intervals. The bonds have been issued since april 1st 2003 and will be issued till further notice from the government via a. Bond refers to a security issued by a company,.

Real estate buy & sell property; Electronic form held in the bond ledger account. Buy them in electronic form in our online program treasurydirect;

Bond ledger account will be opened by the receiving office in the name of investor/s. You can approach your demat stock broker or. Know more about tax free bonds in india.

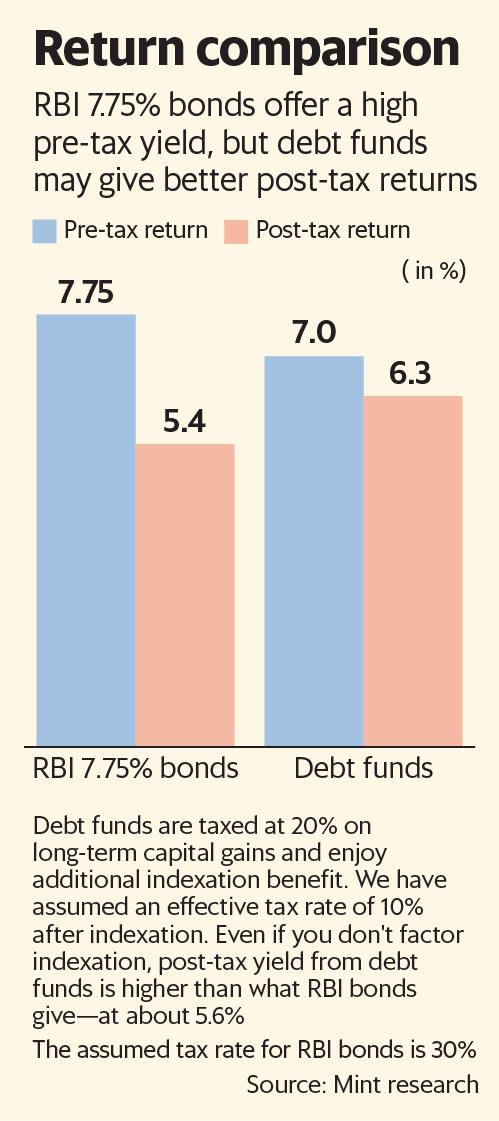

Buy them in paper form using your federal income tax refund; Investment bonds are a way to raise money. The cumulative option results in annual yield of 8.16% as interest is.

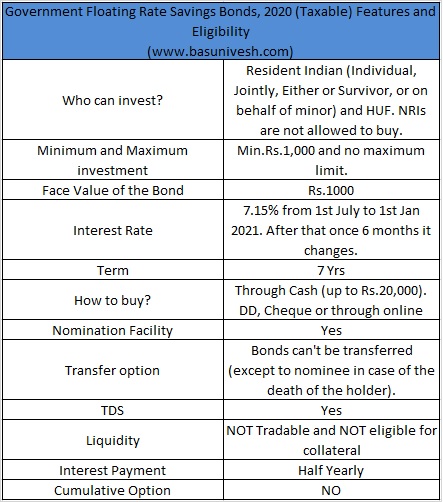

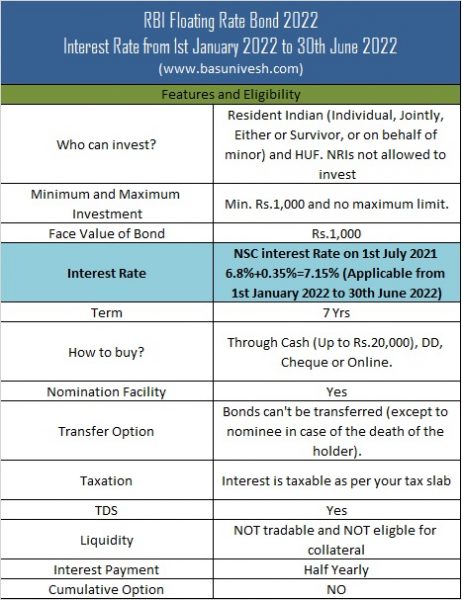

The bonds can be bought through the cheques/cash/drafts. 7.75% goi savings bond as per the rbi directive, 7.75% goi savings bond bonds can be held by: Bids can be placed on the gobid web platform or the nse gobid mobile app.

An individual or individuals who are not nri. Bond refers to a security issued by a company, financial institution or government, which offers. Once you have reviewed its pros and cons, you might think how to buy government bonds.