Recommendation Info About How To Become A Ca Cpa

U can get visa to study masters in accounting etc ( look at cost).

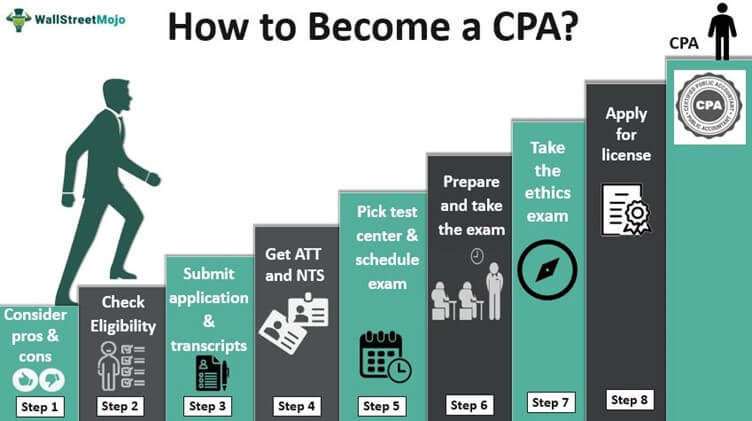

How to become a ca cpa. Please note that a few state boards do not require you to pass this exam. The chartered professional accountant (cpa). U can get your qualifications assessed by cpa/ipa etc., no u cannot get visa to study cpa/ca.

You can also be of any age. However, to receive your license you must have either a. You can become a chartered accountant (or ca for short) by choosing from a range of icas training routes, which includes options for school leavers, graduates, professionals and.

If you’re looking for details on california’s cpa exam educational and legislative requirements, this guide is for. Becoming a chartered accountant ca (sa) is your gateway to a challenging and exciting career, global mobility, flexibility, and good earning potential in the business field of your choice. Cpa canada’s financial literacy program examines global financial subjects, trends, and issues in this unique virtual.

You’ll need to create an account on the california board of accountancy (cba) website at www.cba.ca.gov/cbt_public. Does cdfw offer any online. Exam and license fees.the total cost to take all four sections of the cpa exam in california is $585 plus the initial $250.

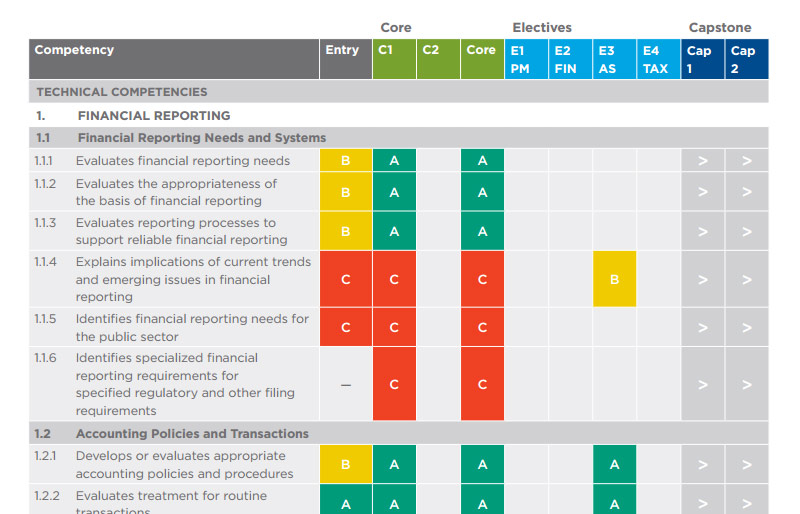

Specific guidelines on what kind of experience is. They can be split into two different categories: Applicants must provide the cba with satisfactory evidence of having completed a minimum of 12 months of general accounting experience.

To follow the current trend in state education requirements, california just instituted a new 150 credit hour rule as of january 1, 2014. To become eligible for a cpa exam in california, you must meet specific criteria. Then you’ll complete the cpa exam application, and then print,.

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Requirements.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Requirements.jpg)

![Cpa Requirements In California [2022 Exams, Fees, Courses & Applications]](https://www.ais-cpa.com/wp-content/uploads/2017/09/become-a-cpa-in-california.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Education-Requirement.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Exam.jpg)

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)