Great Tips About How To Buy Corporate Bonds Fidelity

Submit buy orders for new issue treasury, cd, gse/agency, and corporate notes sm inventory.

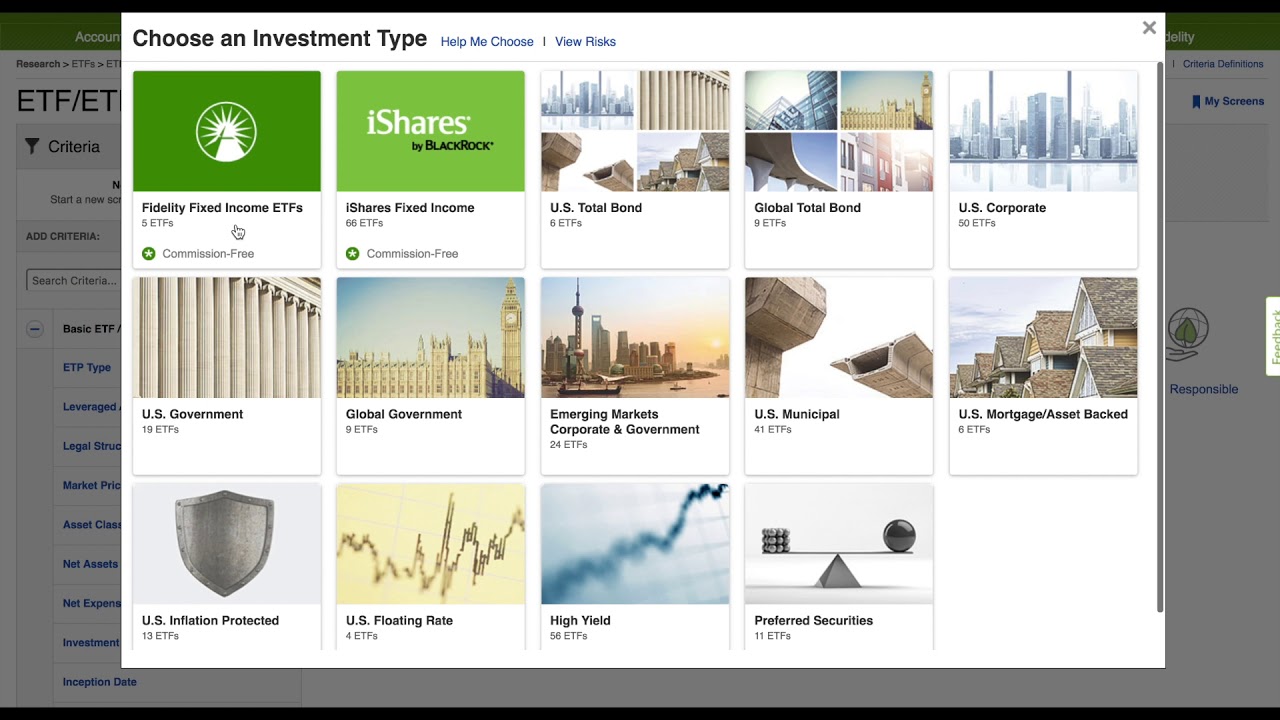

How to buy corporate bonds fidelity. Check out benzinga's top picks for best corporate bond funds. A standard yield calculation developed by the securities and exchange commission for bond funds. And with a net expense ratio of 0.25%, that's only a $25 fee for every $10,000 invested per year.

Treasury purchases traded with a fidelity representative, a flat charge of $19.95 per trade. Google images copyright free x uses of radioisotopes in industry. Treasury purchases traded with a fidelity representative, a flat charge.

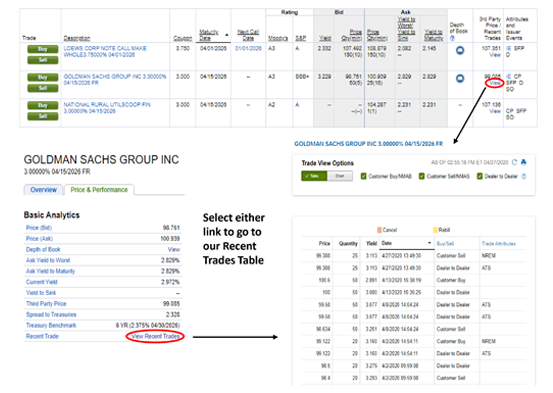

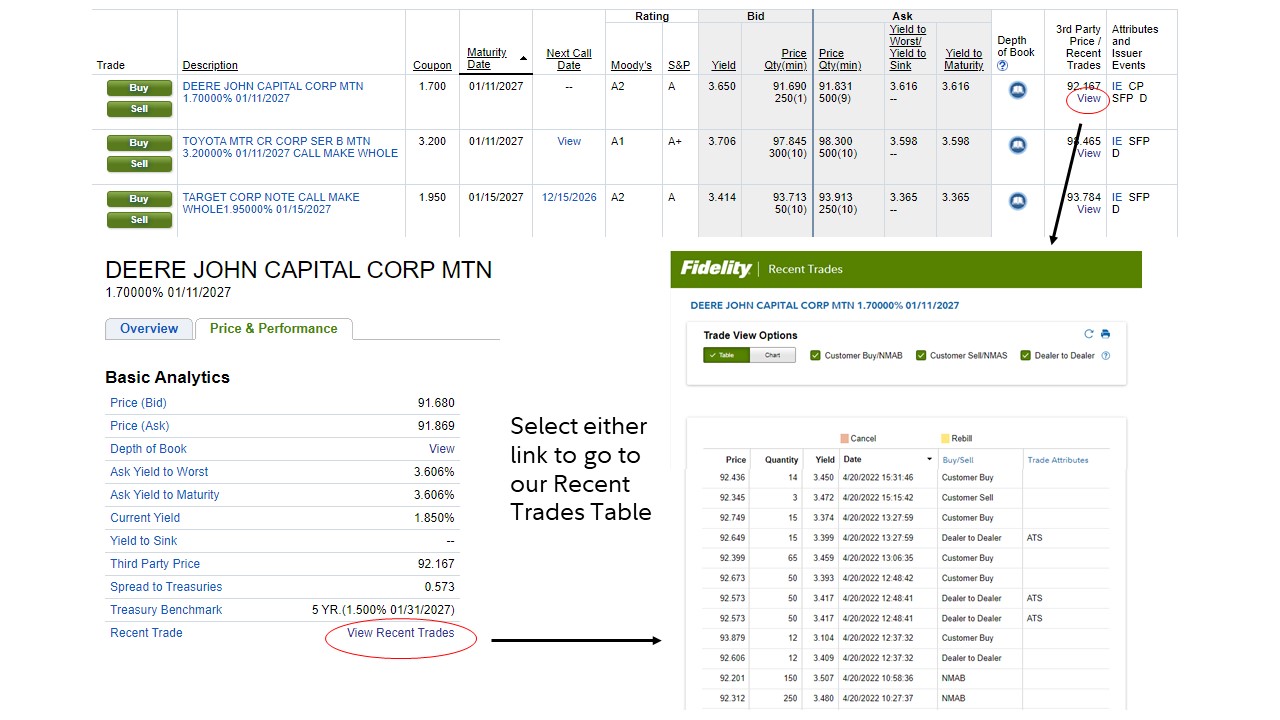

In this video i show you how to buy bonds through fidelity's trading platform. To buy bonds on fidelity, you must log into your brokerage account and navigate to the “fixed income” section, where they will show a. If you have the cusip, all you need to do is log into fidelity and then do the following:

Because they have yet to accrue any interest, you pay. You may search for and purchase high yield bonds at fidelity.com, where you can choose the credit rating levels appropriate for your portfolio and risk tolerance. As noted above, treasury bonds are issued in increments of.

Minimum markup or markdown of $19.95 applies if traded with a fidelity representative. Buying secondary treasuries on fidelity. You can purchase government bonds like u.s.

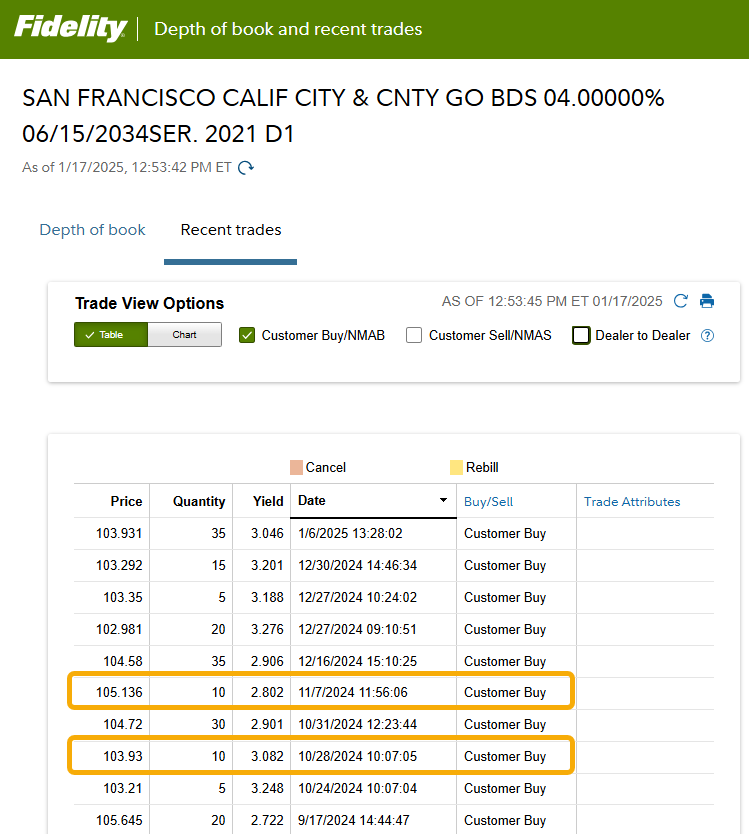

You can always count on vanguard for low fees, and the vanguard. This program allows you to buy new issue corporate bonds directly from the issuer in $1,000 increments. For secondary market bonds and cd purchases, the difference (dollar and %) between the prevailing market price (pmp) and the trade price.

![Step-By-Step Guide] How To Buy Treasury Bonds On Secondary Market From Fidelity Brokerage — My Money Blog](https://www.mymoneyblog.com/wordpress/wp-content/uploads/2022/07/fid_tbond_sec1.gif)

![Step-By-Step Guide] How To Buy Treasury Bonds On Secondary Market From Fidelity Brokerage — My Money Blog](https://www.mymoneyblog.com/wordpress/wp-content/uploads/2022/07/fid_tbond_sec3b.gif)