Nice Info About How To Handle Bankruptcy

2) contact the bankruptcy trustee 3.1.

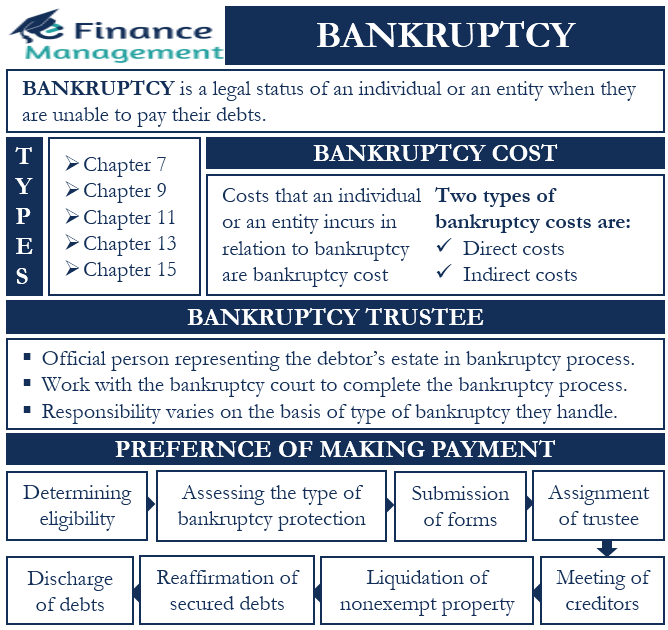

How to handle bankruptcy. Pay your bills on time. When you realize that your business is facing bankruptcy, it is paramount to take some immediate action and help the business to survive. Bankruptcy trustees are more powerful than foreclosure trustees 3.2.

A debtor will file bankruptcy through legal channels so that a trustee or bankruptcy lawyer will be able to analyze their assets and debts and handle the liquidation of. You should only use bankruptcy attorneys that have a great reputation with the court system and who have won a lot of cases. How to recover from bankruptcy start tracking your income and expenses.

No matter what you think of donald trump as a president, he is good at surviving bankruptcy. The trustee assigned to oversee the bankruptcy handles the liquidation of all business assets. A bankruptcy case normally begins when the debtor files a petition with the bankruptcy court.

In summation, although filing for bankruptcy likely provides a bankrupt party to an interest rate swap agreement the power to assume or reject the agreement as an executory contract under. We have helped tens of thousands get a fresh start! You will want to hire someone who knows what.

Any proceeds from the sale go to creditors and the trustee handles the. Your credit will recover faster if you don't file bankruptcy. No other court can proceed with the distribution of assets, and neither party can access the.

Even though this is pretty basic, you must be even more aware of your income. Ad unlike bankruptcy, debt consolidation doesn't require upfront fees or repay debts in full. Once you receive notification that your member is in bankruptcy, you should complete the following procedures on the member’s account.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

:max_bytes(150000):strip_icc()/Term-b-bankruptcy_Final-8b9acc7012e24c9d9e7315adf2be72fe.png)