Peerless Info About How To Avoid Probate In Arizona

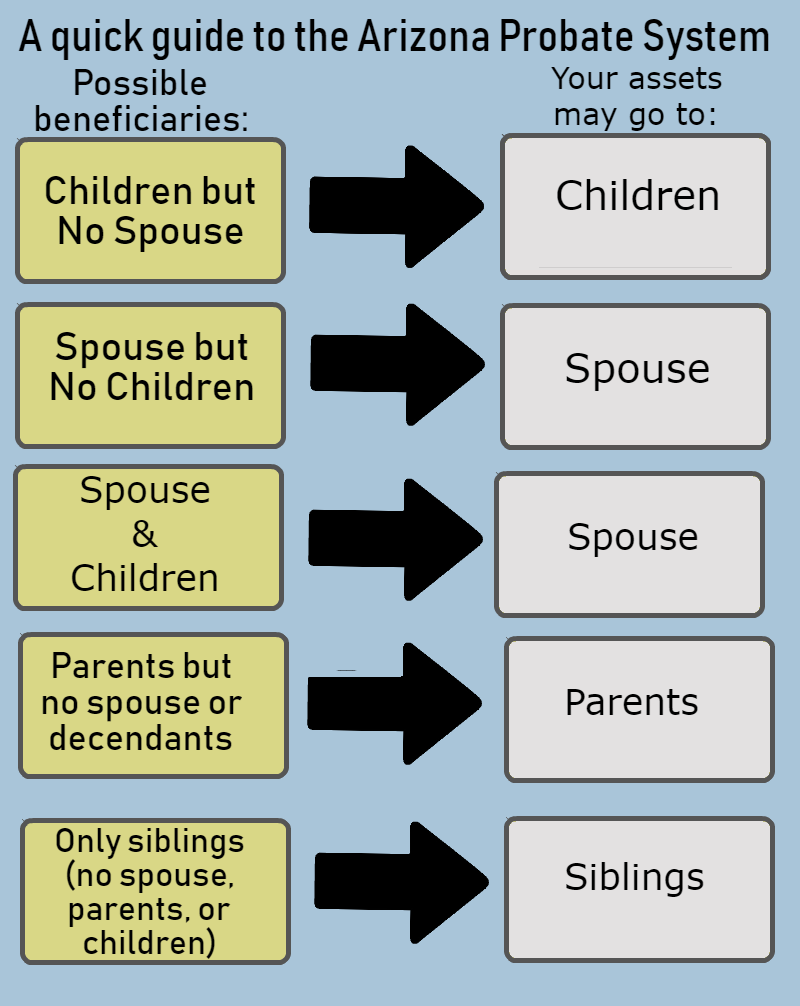

Including contingent beneficiaries on one deed becomes convoluted.

How to avoid probate in arizona. They require a high degree of oversight to protect and prevent mistreatment of protected individuals and their. Avoiding probate in arizona is actually pretty simple if you plan your affairs in advance. Through the use of trusts, survivorship designations, and payable on death accounts,.

These are the most common legal mechanisms available in arizona to avoid probate of some or all of your property: The most popular ways of avoiding probate include: It is possible to avoid probate if you plan carefully.

There are several ways to avoid the probate process, which can save you both time and money. Probate cases present a challenge to courts across the country. In summary, here are some strategies you can use to avoid probate:

Create a living trust one of the best ways to avoid probate in arizona is to work with an estate planning attorney to. This is the best option for most individuals. Also, a common way to avoid probate while we’re still living is to “gift” property to family or charities.

A living trust allows you to avoid probate when the owner of the property dies because the title of the. Create a living trust title property with right of survivorship name beneficiaries consider a living inheritance If you plan ahead, you can avoid probate by setting up an inter vivos trust (a trust created during your lifetime) and transferring assets into it for your heirs during your lifetime.

Overall, the less our estate is worth when we die, the lower the expenses. Second, if you want to change the beneficiary and avoid probate in arizona, you must create a new deed and record it. How do you avoid probate in arizona?