Supreme Tips About How To Become A Personal Financial Planner

Personal financial specialist (pfs) awarded by american institute of cpas.

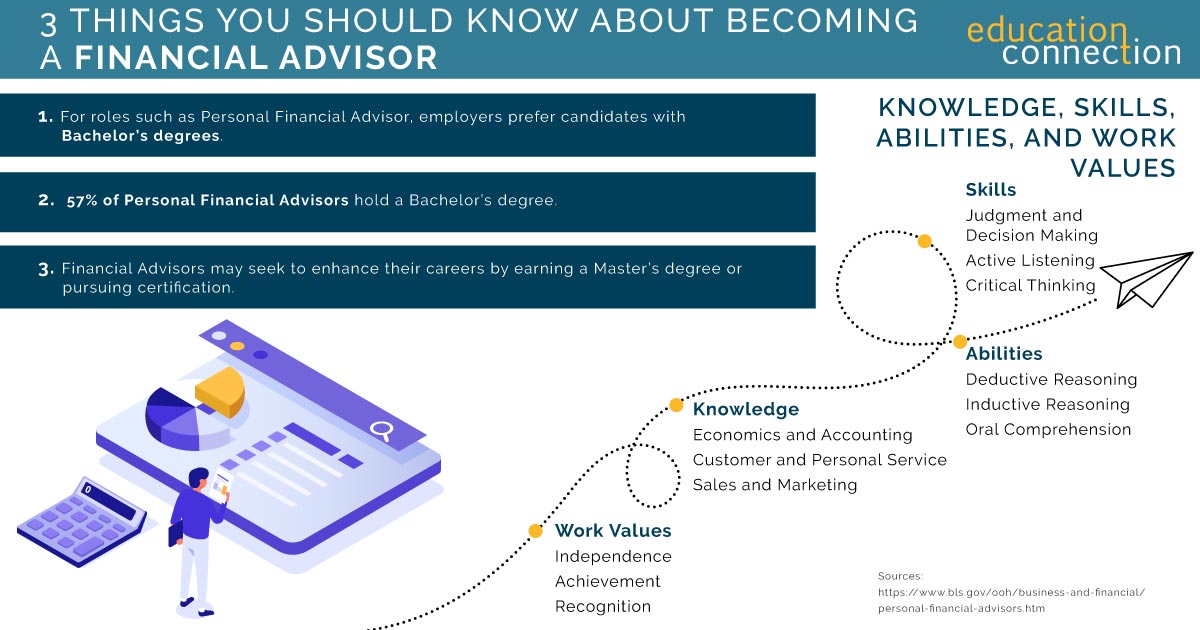

How to become a personal financial planner. The first step toward becoming a financial advisor is to get a job at a firm that will sponsor you for your licenses. After passing the fpe1, candidates must obtain three years of qualifying experience as a personal financial planner. Provide clients with unbiased and unrestricted information and advice on new and existing financial products and services to.

A noteworthy mention is the certified financial planner (cfp) designation. A certified financial planner (cfp) label indicates training and experience in comprehensive planning. An advisor must be able to blend their education along with their interpersonal skills and experience, in order to be good in this field.

Certified financial planner (cfp) awarded by certified planner board of standards, inc. Prior to registering to take the fpe2, they must have at least one. The financial planning program attending the 2017 financial planning association annual conference in nashville, tennessee.

Some firms hire people with no experience in the. There are several components to obtaining the cfp® mark: To earn this, you will require a bachelor’s degree, a minimum of 3 years of relevant work experience,.

Check a cfp’s credentials at letsmakeaplan.org. If you want to work as a certified public accountant who specializes in financial planning, you can become a credentialed as a pfs. A personal financial planner would typically need to:

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)

/GettyImages-815165952-352474d31efb4d44967695dc81f2ee2a.jpg)

/GettyImages-1141794009-4f91977b15c14298b545252ae57acdc4.jpg)

:max_bytes(150000):strip_icc()/financial_advisor_calculator-5bfc2eff46e0fb00517c8ba3.jpg)