Build A Tips About How To Avoid Probate By Creating A Living Trust

Accordingly, probate is avoided on assets placed.

How to avoid probate by creating a living trust. Establish joint ownership of property. Joint tenancy with right of survivorship. Include gifts a part of your estate plan.

Beneficiary forms by nature not. Creating a trust to avoid probate you can establish a simple living trust by signing a document called a declaration of faith, similar to a will. It also creates an avenue.

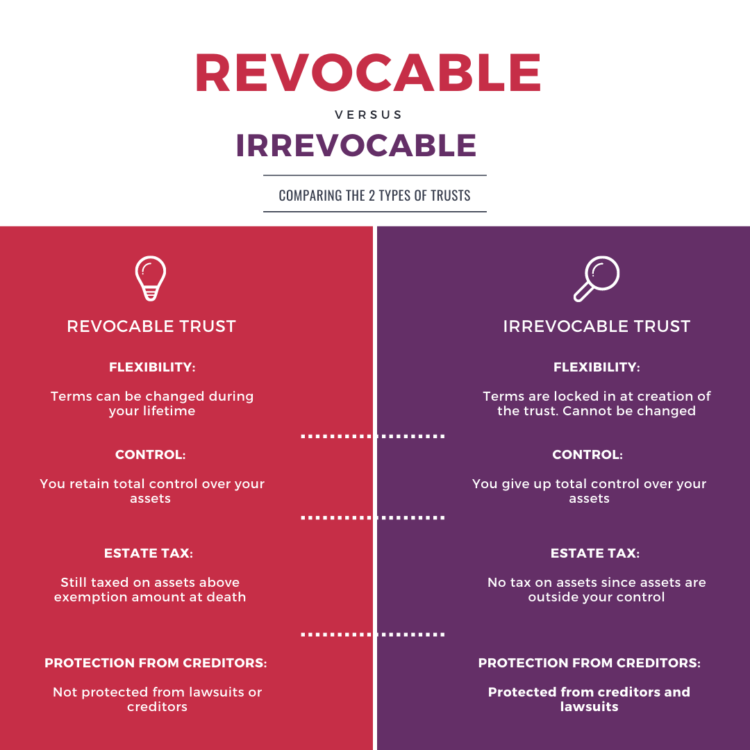

It's a trust that you set up during your. For this reason, a pour over will can be thought of as a “backup plan” for the existing living trust. A revocable living trust is an instrument created for the purpose of protecting your assets during your lifetime.

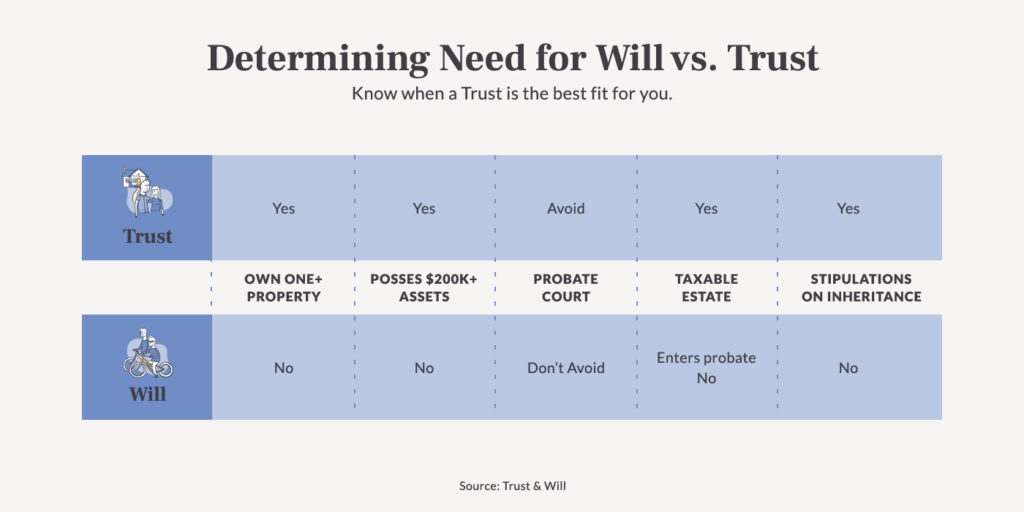

But you don’t have to go through the expense of creating a trust and managing your assets through it. Set up financial accounts and securities to transfer on death. Create a living trust and skip probate if a person has established a living trust prior to passing away, then their family and loved ones can skip the probate process altogether and receive.

A living trust is set up to transfer the assets directly to alternate beneficiaries after the creator of the trust passes away. A surviving owner of a joint tenancy automatically inherits the property of the one who passes. Up to 25% cash back when you make a living trust, your surviving family members can transfer your property quickly and easily, without probate.

The living trust works to avoid probate because the trust itself owns any assets you transfer into it. More of the property you leave goes to the. Up to 25% cash back you can create a trust simply by preparing and signing a document called a declaration of trust.